Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your clothing line such as designing clothing, manufacturing, procuring supplies, managing inventory, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to sell your 1,000th item, or when you hope to reach $X in sales. It could also be when you expect to hire your Xth employee or launch a new clothing line.

Management Team

To demonstrate your clothing line’s ability to succeed as a business, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in the clothing line business. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in clothing line businesses and/or successfully running retail and small businesses.

Financial Plan

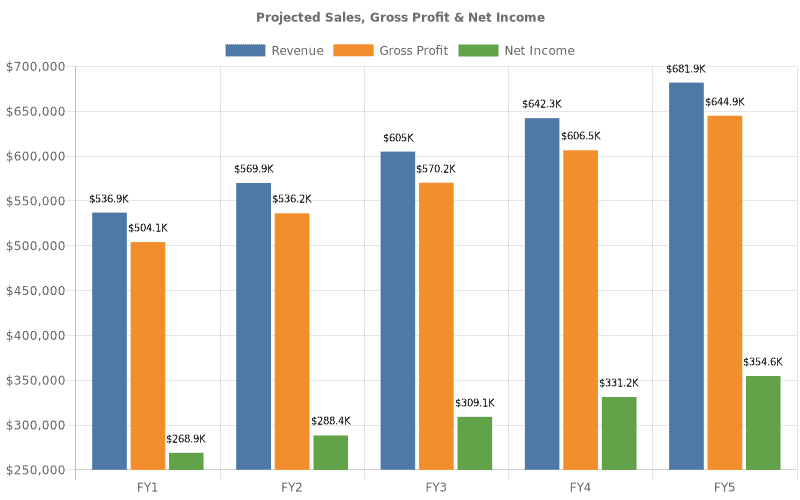

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements. The graph below is an example of the financial projections for a clothing line business.

Projected Sales, Gross Profit & Net Income

Income Statement: an income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you sell 100 items per day or 200? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Example 5 Year Annual Income Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Revenues | $536,853 | $569,923 | $605,029 | $642,298 | $681,863 | |

| Total Revenues | $536,853 | $569,923 | $605,029 | $642,298 | $681,863 | |

| Direct Costs | ||||||

| Direct Costs | $32,766 | $33,760 | $34,784 | $35,840 | $36,927 | |

| Total Direct Costs | $32,766 | $33,760 | $34,784 | $35,840 | $36,927 | |

| GROSS PROFIT | $504,087 | $536,162 | $570,244 | $606,458 | $644,936 | |

| GROSS PROFIT % | 93.9% | 94.1% | 94.3% | 94.4% | 94.6% | |

| Other Expenses | ||||||

| Salaries | $58,251 | $60,018 | $61,839 | $63,715 | $65,648 | |

| Marketing Expenses | $0 | $0 | $0 | $0 | $0 | |

| Rent/Utility Expenses | $0 | $0 | $0 | $0 | $0 | |

| Other Expenses | $12,135 | $12,503 | $12,883 | $13,274 | $13,676 | |

| Total Other Expenses | $70,386 | $72,522 | $74,722 | $76,989 | $79,325 | |

| EBITDA | $433,700 | $463,640 | $495,522 | $529,469 | $565,610 | |

| Depreciation | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | |

| Amortization | $0 | $0 | $0 | $0 | $0 | |

| EBIT | $423,700 | $453,640 | $485,522 | $519,469 | $555,610 | |

| Interest Expense | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | |

| PRETAX INCOME | $413,700 | $443,640 | $475,522 | $509,469 | $545,610 | |

| Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Use of Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Taxable Income | $413,700 | $443,640 | $475,522 | $509,469 | $545,610 | |

| Income Tax Expense | $144,795 | $155,274 | $166,432 | $178,314 | $190,963 | |

| NET INCOME | $268,905 | $288,366 | $309,089 | $331,154 | $354,647 | |

| Net Profit Margin (%) | 50.1% | 50.6% | 51.1% | 51.6% | 52% |

Balance Sheets: While balance sheets include much information, to simplify them to the key items you need to know about, balance sheets show your assets and liabilities. For instance, if you spend $100,000 on building out your clothing line design shop, that will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $100.000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Example 5 Year Annual Balance Sheet

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| ASSETS | ||||||

| Cash | $291,852 | $587,664 | $904,034 | $1,243,393 | $1,505,028 | |

| Other Current Assets | $45,745 | $48,563 | $51,554 | $53,524 | $56,821 | |

| Total Current Assets | $337,597 | $636,227 | $955,588 | $1,296,918 | $1,561,850 | |

| Intangible Assets | $0 | $0 | $0 | $0 | $0 | |

| Acc Amortization | $0 | $0 | $0 | $0 | $0 | |

| Net Intangibles | $0 | $0 | $0 | $0 | $0 | |

| Fixed Assets | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | |

| Accum Depreciation | $10,000 | $20,000 | $30,000 | $40,000 | $50,000 | |

| Net fixed assets | $40,000 | $30,000 | $20,000 | $10,000 | $0 | |

| Preliminary Exp | $0 | $0 | $0 | $0 | $0 | |

| TOTAL ASSETS | $377,597 | $666,227 | $975,588 | $1,306,918 | $1,561,850 | |

| LIABILITIES & EQUITY | ||||||

| Current Liabilities | $8,692 | $8,956 | $9,228 | $9,402 | $9,687 | |

| Debt outstanding | $100,000 | $100,000 | $100,000 | $100,000 | $0 | |

| Total Liabilities | $108,692 | $108,956 | $109,228 | $109,402 | $9,687 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | $268,905 | $557,271 | $866,360 | $1,197,515 | $1,552,162 | |

| Total Equity | $268,905 | $557,271 | $866,360 | $1,197,515 | $1,552,162 | |

| TOTAL LIABILITIES & EQUITY | $377,597 | $666,227 | $975,588 | $1,306,918 | $1,561,850 |

Cash Flow Statement: Your cash flow statement will help determine how much money you need to start or grow your business, and make sure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt. For example, let’s say a retailer approached you with a massive $100,000 contract to design and manufacture apparel for them. And that doing so would cost you $50,000 to fulfill. Well, in most cases, you would have to pay that $50,000 now for supplies, employee salaries, etc. But let’s say the company didn’t pay you for 180 days. During that 180 day period, you could run out of money.

Example 5 Year Annual Cash Flow Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| CASH FLOW FROM OPERATIONS | ||||||

| Net Income (Loss) | $268,905 | $288,366 | $309,089 | $331,154 | $354,647 | |

| Change in Working Capital | ($37,052) | ($2,554) | ($2,719) | ($1,795) | ($3,011) | |

| Plus Depreciation | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | |

| Plus Amortization | $0 | $0 | $0 | $0 | $0 | |

| Net Cash Flow from Operations | $241,852 | $295,812 | $316,369 | $339,359 | $361,635 | |

| CASH FLOW FROM INVESTMENTS | ||||||

| Fixed Assets | ($50,000) | $0 | $0 | $0 | $0 | |

| Intangible Assets | $0 | $0 | $0 | $0 | $0 | |

| Net Cash Flow from Investments | ($50,000) | $0 | $0 | $0 | $0 | |

| CASH FLOW FROM FINANCING | ||||||

| Cash from Equity | $0 | $0 | $0 | $0 | $0 | |

| Cash from Debt financing | $100,000 | $0 | $0 | $0 | ($100,000) | |

| Net Cash Flow from Financing | $100,000 | $0 | $0 | $0 | ($100,000) | |

| Net Cash Flow | $291,852 | $295,812 | $316,369 | $339,359 | $261,635 | |

| Cash at Beginning of Period | $0 | $291,852 | $587,664 | $904,034 | $1,243,393 | |

| $291,852 | $587,664 | $904,034 | $1,243,393 | $1,505,028 |

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a clothing line:

- Design house and/or manufacturing facility build-out including design fees, construction, etc.

- Cost of equipment like sewing machines, etc.

- Cost of supplies/inventory

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Appendix

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include some of your apparel designs.

Clothing Line Business Plan Summary

Putting together a business plan for your clothing line is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will really understand the clothing line business, your competition and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful clothing line.

Download Our Clothing Line Business Plan PDF

You can download our clothing line business plan PDF here. This is a business plan template you can use in PDF format.

Clothing Line Business Plan FAQs

What Is the Easiest Way to Complete My Clothing Line Business Plan?

Growthink's Ultimate Clothing Line Business Plan Template allows you to quickly and easily complete your Clothing Line Business Plan.

Where Can I Download a Clothing Line Business Plan PDF?

You can download our clothing line business plan PDF template here. This is a clothing line business plan example you can use in PDF format.

Finish Your Clothing Line Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your Clothing Line business plan?

With Growthink’s Ultimate Clothing Line Business Plan Template you can finish your plan in just 8 hours or less!

Click here to finish your Clothing Line business plan today.

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how a Growthink business plan writer can create your business plan for you.

Use This Simple Business Plan Template

Use This Simple Business Plan Template How to Create a Great Business Plan

How to Create a Great Business Plan The Perfect Outline for a Business Plan

The Perfect Outline for a Business Plan How to Expertly Format a Business Plan

How to Expertly Format a Business Plan 100 Free Business Plan Examples

100 Free Business Plan Examples Business Plan Consulting Services

Business Plan Consulting Services Clothing Store Business Plan

Clothing Store Business Plan Fashion Business Plan Template

Fashion Business Plan Template Boutique Business Plan Template

Boutique Business Plan Template