Starting a credit repair business can be very profitable. With proper planning, execution and hard work, you can enjoy great success. Below you will learn the keys to launching a successful credit repair business.

Importantly, a critical step in starting a credit repair business is to complete your business plan. To help you out, you should download Growthink’s Ultimate Business Plan Template here.

14 Steps To Start a Credit Repair Business

- Choose the Name for Your Credit Repair Business

- Develop Your Credit Repair Business Plan

- Choose the Legal Structure for Your Credit Repair Business

- Secure Startup Funding for Your Credit Repair Business (If Needed)

- Secure a Location for Your Business

- Register Your Credit Repair Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Credit Repair Business

- Buy or Lease the Right Credit Repair Business Equipment

- Develop Your Credit Repair Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Credit Repair Business

- Open for Business

1. Choose the Name for Your Credit Repair Business

The first step to starting a credit repair business is to choose your business’ name.

This is a very important choice since your company name is your brand and will last for the lifetime of your business. Ideally you choose a name that is meaningful and memorable. Here are some tips for choosing a name for your credit repair business:

- Make sure the name is available. Check your desired name against trademark databases and your state’s list of registered business names to see if it’s available. Also check to see if a suitable domain name is available.

- Keep it simple. The best names are usually ones that are easy to remember, pronounce and spell.

- Think about marketing. Come up with a name that reflects the desired brand and/or focus of your credit repair business.

2. Develop Your Credit Repair Business Plan

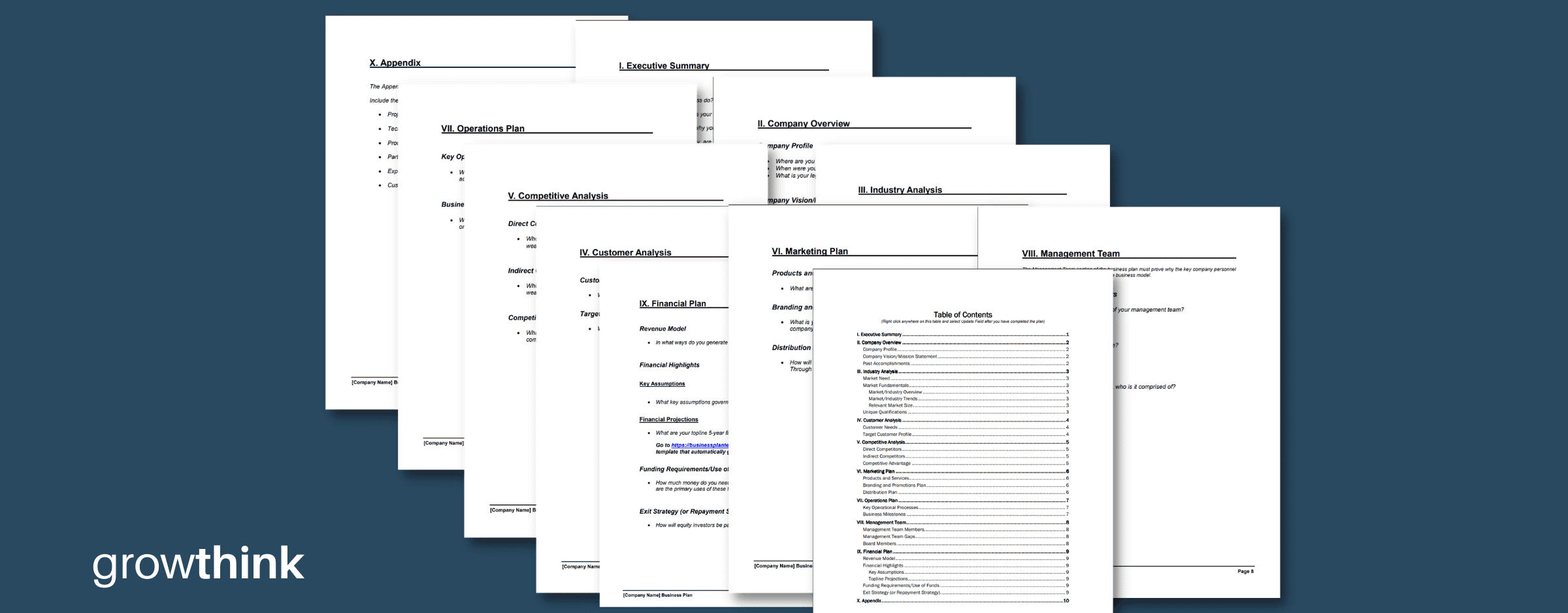

One of the most important steps in starting a credit repair business is to develop your business plan. The entire process of creating your plan ensures that you fully understand your market and your business strategy. The plan also provides you with a roadmap to follow and if needed, to present to funding sources to raise capital for your business.

Your business plan should include the following sections:

- Executive Summary – this section should summarize your entire business plan so readers can quickly understand the key details of your credit repair business.

- Company Overview – this section tells the reader about the history of your credit repair business and what type of credit repair business you operate. For example, are you a credit counseling, credit optimization, or credit restoration business.

- Industry Analysis – here you will document key information about the credit repair industry. Conduct market research and document how big the industry is and what trends are affecting it.

- Customer Analysis – in this section, you will document who your ideal or target customers are and their demographics. For example, how old are they? Where do they live? What do they find important when purchasing services like the ones you will offer?

- Competitive Analysis – here you will document the key direct and indirect competitors you will face and how you will build competitive advantage.

- Marketing Plan – your marketing plan should address the 4Ps: Product, Price, Promotions and Place.

- Product: Determine and document what products/services you will offer

- Prices: Document the prices of your products/services

- Place: Where will your business be located and how will that location help you increase sales?

- Promotions: What promotional methods will you use to attract customers to your credit repair business? For example, you might decide to use pay-per-click advertising, public relations, search engine optimization and/or social media marketing.

- Operations Plan – here you will determine the key processes you will need to run your day-to-day operations. You will also determine your staffing needs. Finally, in this section of your plan, you will create a projected growth timeline showing the milestones you hope to achieve in the coming years.

- Management Team – this section details the background of your company’s management team.

- Financial Plan – finally, the financial plan answers questions including the following:

- What startup costs will you incur?

- How will your credit repair business make money?

- What are your projected sales and expenses for the next five years?

- Do you need to raise funding to launch your business?

Finish Your Business Plan Today!

If you’d like to quickly and easily complete your business plan, download Growthink’s Ultimate Business Plan Template and complete your plan and financial model in hours.

3. Choose the Legal Structure for Your Credit Repair Business

Next you need to choose a legal structure for your new business and register it and your business name with the Secretary of State in each state where you operate your business.

Below are the five most common legal structures:

1) Sole proprietorship

A sole proprietorship is a business entity in which the credit repair business owner and the business are the same legal person. The owner of a sole proprietorship is responsible for all debts and obligations of the business. There are no formalities required to establish a sole proprietorship, and it is easy to set up and operate. The main advantage of a sole proprietorship is that it is simple and inexpensive to establish. The main disadvantage is that the owner is liable for all debts and obligations of the business.

2) Partnerships

A partnership is a legal structure that is popular among small business owners. It is an agreement between two or more people who want to start a credit repair business together. The partners share in the profits and losses of the business.

The advantages of a partnership are that it is easy to set up, and the partners share in the profits and losses of the business. The disadvantages of a partnership are that the partners are jointly liable for the debts of the business, and disagreements between partners can be difficult to resolve.

3) Limited Liability Company (LLC)

A limited liability company, or LLC, is a type of business entity that provides limited liability to its owners. This means that the owners of an LLC are not personally responsible for the debts and liabilities of the business. The advantages of an LLC for a credit repair business include flexibility in management, pass-through taxation (avoids double taxation as explained below), and limited personal liability. The disadvantages of an LLC include lack of availability in some states and self-employment taxes.

4) C Corporation

A C Corporation is a business entity that is separate from its owners. It has its own tax ID and can have shareholders. The main advantage of a C Corporation for a credit repair business is that it offers limited liability to its owners. This means that the owners are not personally responsible for the debts and liabilities of the business. The disadvantage is that C Corporations are subject to double taxation. This means that the corporation pays taxes on its profits, and the shareholders also pay taxes on their dividends.

5) S Corporation

An S Corporation is a type of corporation that provides its owners with limited liability protection and allows them to pass their business income through to their personal income tax returns, thus avoiding double taxation. There are several limitations on S Corporations including the number of shareholders they can have among others.

Once you register your credit repair business, your state will send you your official “Articles of Incorporation.” You will need this among other documentation when establishing your banking account (see below). We recommend that you consult an attorney in determining which legal structure is best suited for your company.

Incorporate Your Business at the Guaranteed Lowest Price

We are proud to have partnered with Business Rocket to help you incorporate your business at the lowest price, guaranteed.

Not only does BusinessRocket have a 4.9 out of 5 rating on TrustPilot (with over 1,000 reviews) because of their amazing quality…but they also guarantee the most affordable incorporation packages and the fastest processing time in the industry.

Incorporate with BusinessRocket at the guaranteed lowest price now.

4. Secure Startup Funding for Your Credit Repair Business (If Needed)

In developing your credit repair business plan, you might have determined that you need to raise funding to launch your business.

If so, the main sources of funding for a credit repair business to consider are personal assets and savings, family and friends, credit card financing, bank loans, crowdfunding and angel investors. Angel investors are individuals who provide capital to early-stage businesses. Angel investors typically will invest in a credit repair business that they believe has high potential for growth.

5. Secure a Location for Your Business

When starting a credit repair business, you’ll need to find a location. Here are some tips on how to find the right location for your business:

- Start by identifying your target market. Where do your customers live? What areas do you want to target?

- Look for areas that have a high population density. This will ensure that you have a large customer base to draw from.

- Choose a site that is centrally located. This will make it easier for your customers to access your business.

- Make sure the area is affordable. You don’t want to overspend on rent or property taxes.

- Consider the logistical considerations. Is the area easily accessible by car? Is there adequate parking?

- Think about accessibility to public transportation. What’s the catchment area for your business location?

- Don’t forget to consider the overall look and feel of the area. It should be presentable and it should reflect well on your business.

- Also, some state credit repair laws may affect where you can set up shop and some cities and townships prohibit credit repair businesses from operating in their jurisdictions. Check your local laws before you choose a location.

- Don’t forget to examine the competition in the area you want to set up shop. Do any other credit repair businesses operate nearby? If so, then you’ll have stiff competition from them and that will make your job harder when it comes to attracting credit repair clients.

- Finally, consider your own needs when searching for a location for your credit repair business. Do you need a place with a lot of office space? Will you be conducting any home visits in the local area? Consider all of your own needs when deciding on a location.

6. Register Your Credit Repair Business with the IRS

Next, you need to register your business with the Internal Revenue Service (IRS) which will result in the IRS issuing you an Employer Identification Number (EIN).

Most banks will require you to have an EIN in order to open up an account. In addition, in order to hire employees, you will need an EIN since that is how the IRS tracks your payroll tax payments.

Note that if you are a sole proprietor without employees, you generally do not need to get an EIN. Rather, you would use your social security number (instead of your EIN) as your taxpayer identification number.

7. Open a Business Bank Account

It is important to establish a bank account in your credit repair business’ name. This process is fairly simple and involves the following steps:

- Identify and contact the bank you want to use

- Gather and present the required documents (generally include your company’s Articles of Incorporation, driver’s license or passport, and proof of address)

- Complete the bank’s application form and provide all relevant information

- Meet with a banker to discuss your business needs and establish a relationship with them

8. Get a Business Credit Card

You should get a business credit card for your credit repair business to help you separate personal and business expenses.

You can either apply for a business credit card through your bank or apply for one through a credit card company.

When you’re applying for a business credit card, you’ll need to provide some information about your business. This includes the name of your business, the address of your business, and the type of business you’re running. You’ll also need to provide some information about yourself, including your name, Social Security number, and date of birth.

Once you’ve been approved for a business credit card, you’ll be able to use it to make purchases for your business. You can also use it to build your credit history which could be very important in securing loans and getting credit lines for your business in the future.

9. Get the Required Business Licenses and Permits

In order to start a profitable credit repair business, you will need to obtain a business license. Further, some states require a surety bond, and registration as a Credit Service Organization (CSO).

10. Get Business Insurance for Your Credit Repair Business

Here are business insurance policies that you should consider for your credit repair business:

- General liability insurance: This covers accidents and injuries that occur on your property. It also covers damages caused by your employees or products.

- Workers’ compensation insurance: If you have employees, this type of policy works with your general liability policy to protect against workplace injuries and accidents. It also covers medical expenses and lost wages.

- Professional liability insurance: This protects your business against claims of professional negligence.

Find an insurance agent, tell them about your business and its needs, and they will recommend policies that fit those needs.

11. Buy or Lease the Right Credit Repair Business Equipment

To start a credit repair business, you will need some basic office equipment. You will need a computer, phone, and internet connection. Some credit repair businesses also find a printer, scanner, and copier useful.

12. Develop Your Credit Repair Business Marketing Materials

Marketing materials will be required to attract and retain customers to your credit repair business today.

The key marketing materials you will need are as follows:

- Logo: Spend some time developing a good logo for your credit repair business. Your logo will be printed on company stationery, business cards, marketing materials and so forth. The right logo can increase customer trust and awareness of your brand.

- Website: Likewise, a professional credit repair business’s website provides potential customers with information about the services you offer, your company’s history, and contact information. Importantly, remember that the look and feel of your website will affect how customers perceive you.

- Social Media Accounts: establish social media accounts in your company’s name. Accounts on Facebook, Twitter, LinkedIn and/or other social media networks will help customers and others find and interact with your credit repair business.

13. Purchase and Setup the Software Needed to Run Your Credit Repair Business

To start a credit repair business, you will need business credit repair software that can help you manage your clients’ information and track their progress.

Some software that you may need includes:

– A customer relationship management (CRM) system to track your clients’ information

– A credit analysis tool to help you assess their credit status

– A payment processing system to manage payments from your clients

– Software to help you keep your business protected from hackers

In addition, it is important that all of the software you use has a high level of data security. Sometimes when people start credit repair businesses they forget about protecting their clients’ financial information. It is critical for your client’s credit repair process to be secure. If you lose or mishandle their personal information, you could be setting them up for identity theft.

14. Open for Business

You are now ready to open your credit repair business. If you followed the steps above, you should be in a great position to build a successful business. Below are answers to frequently asked questions that might further help you.

Other Resources

Credit Repair Mavericks: www.creditrepairmavericks.com

How to Finish Your Ultimate Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your credit repair business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Click here to finish your credit repair business plan today.

How to Start a Credit Repair Business FAQs

Is it hard to start a credit repair business?

The success of a credit repair business depends on a variety of factors, including the quality of services offered and the marketing strategy used. However, there are a few things you can do to improve your chances of success, such as choosing a niche market and building relationships with local businesses.

How can I start a credit repair business with no experience?

There are a few things you can do in order to start a credit repair business with no experience. First, you can research the industry and learn about the different services that credit repair businesses offer. You can also read books and articles on credit repair business online guides about starting your own business. Additionally, you can attend workshops or webinars about starting a credit repair business. Finally, you can purchase a credit repair franchise if you want the support and security of a well-established credit repair business model.

If you have a related degree, such as in finance or business, it will be easier to start your own credit repair business. However, even if you don't have the necessary experience, you can still open your own credit repair company. You simply need to take extra care when doing research and implement a strategic marketing plan upon starting your business.

What type of credit repair business is most profitable?

Businesses that offer credit counseling and credit repair services are generally more successful than those that only offer credit monitoring services. This is because counseling usually involves a level of education about personal finance and credit, which leads to better understanding of how to use credit responsibly -which in turn leads to fewer delinquencies and charge-offs.

In addition, credit repair is generally a more profitable business than monitoring due its higher price point per client. Other factors that affect the profitability of a credit repair business include overhead costs and labor expenses.

How much does it cost to start a credit repair business?

The cost to start a credit repair business can vary depending on the size and scope of the business. However, on average, startup costs can range from $1,000 to $10,000. Some of the key startup expenses associated with starting a credit repair business include:

- Rent or mortgage payment (if you are renting, you may need to make a rent deposit of up to 6 months’ rent)

- Stationary (letterhead, envelopes, business cards)

- Office furniture (desk, chair, filing cabinets, bookcases)

- Technology (computers, phone system, routers, etc.)

- Insurance (liability insurance for protection against unforeseen circumstances)

- Software (while not a requirement, credit repair software will maximize your revenue)

- Marketing materials

What are the ongoing expenses for a credit repair business?

The ongoing expenses for a credit repair business can vary depending on the size and scope of the business. Some of the most common expenses include advertising and marketing, employee salaries, professional fees for accounting services, rent or lease payments, and business licenses or permits. This could also include training expenses for ongoing professional development.

How does a credit repair business make money?

Credit repair companies make money by helping consumers pay off debt.

Many people with less-than-perfect credit find it hard to be approved for loans. A good majority of businesses will not even consider offering them credit, since their repayment history isn’t an accurate predictor of future behavior. Credit repair companies work with clients one-on-one or in group workshops to help them understand how they can limit the negative impact that their past mistakes have had on their finances -- and develop a plan to change that going forward. This might include taking a cash advance from a friend, consolidating debts into one payment per month, or making timely payments on any open collections agencies in order keep them from being turned over to a debt collector for legal action.

Credit repair companies make money by keeping the borrowers they work with on track. They understand that people are more likely to follow through on these promises if they have someone accountable to them, and therefore more likely to pay their monthly fees. A credit repair company usually charges either a flat fee or a subscription fee for its services, or works on a contingency basis -- which means they only get paid when the client manages to successfully pay off a loan.

Is owning a credit repair business profitable?

Yes, here are a few reasons owning a credit repair business can be profitable. For one, there is a lot of demand for credit repair services. In addition, credit repair services are relatively low-cost to offer, which means they have high profit margins. Finally, many people who need credit repair services don't know how to do it themselves or are intimidated by the process, so they are willing to pay for help.

Why do credit repair businesses fail?

One of the most common reasons credit repair businesses fail is because they don't understand how the credit report industry works. Additionally, many credit repair businesses promise clients results that they can't deliver, which often leads to customers becoming frustrated and angry. Finally, credit repair businesses can fail if they're not run efficiently and organized correctly.

Business Plan Template & Guide For Small Businesses

Business Plan Template & Guide For Small Businesses How To Write A Great Business Plan

How To Write A Great Business Plan 100 Business Plan Examples To Use To Create Your Plan

100 Business Plan Examples To Use To Create Your Plan