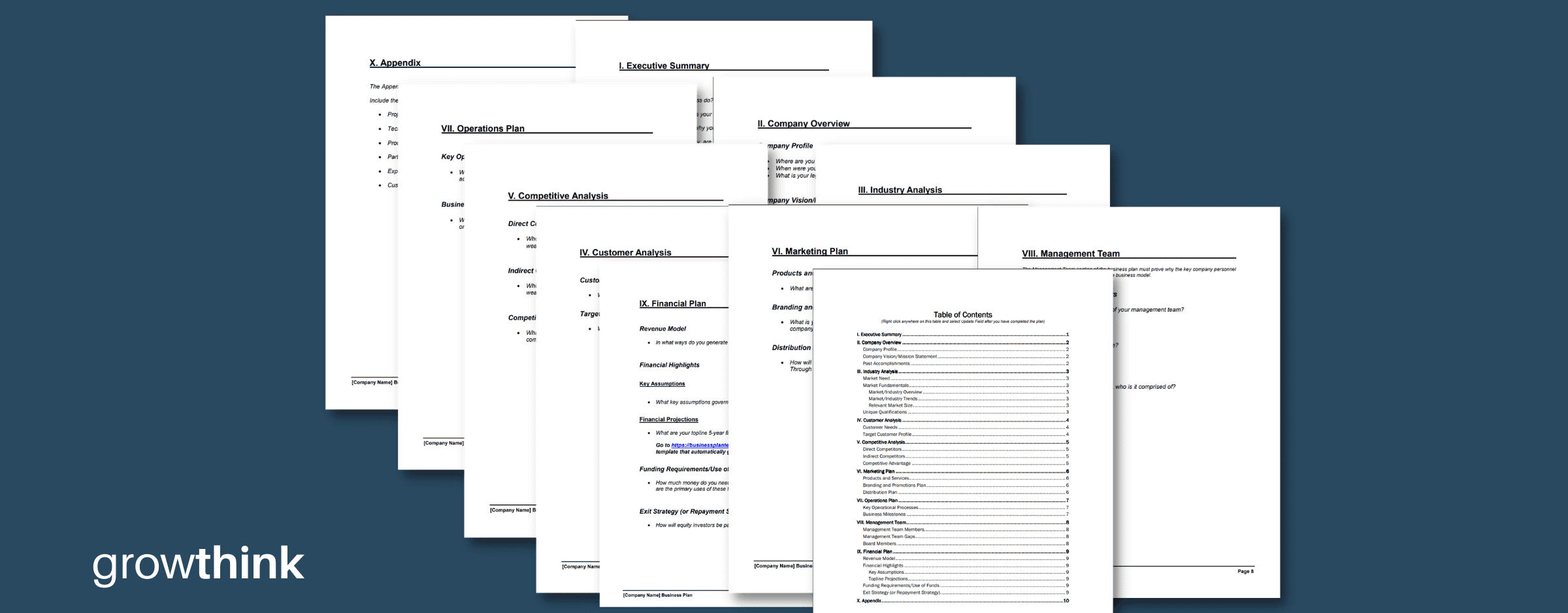

Over the past 20+ years, we have helped over 1 million entrepreneurs and business owners write business plans. These plans have been used to raise funding and grow countless businesses.

From working with all these businesses, we know what the 10 elements in any great business plan. Providing a comprehensive assessment of each of these components is critical in attracting lenders, angel investors, venture capitalists or other equity investors.

Get started with a title page that includes your company name, logo and contact information, since interested readers must have a simple way to find and reach out to you. After that be sure to include the 10 parts of a business plan documented below.

What are the 10 Key Components of a Business Plan?

The 10 sections or elements of a business plan that you must include are as follows:

1. Executive Summary

1. Executive Summary

The executive summary provides a succinct synopsis of the business plan, and highlights the key points raised within. It often includes the company’s mission statement and description of the products and services. It’s recommended by me and many experts including the Small Business Administration to write the executive summary last.

The executive summary must communicate to the prospective investor the size and scope of the market opportunity, the venture’s business and profitability model, and how the resources/skills/strategic positioning of the company’s management team make it uniquely qualified to execute the business plan. The executive summary must be compelling, easy-to-read, and no longer than 2-4 pages.

2. Company Analysis

2. Company Analysis

This business plan section provides a strategic overview of the business and describes how the company is organized, what products and services it offers/will offer, and goes into further detail on the business’ unique qualifications in serving its target markets. As any good business plan template will point out, your company analysis should also give a snapshot of the company’s achievements to date, since the best indicator of future success are past accomplishments.

3. Industry or Market Analysis

3. Industry or Market Analysis

This section evaluates the playing field in which the company will be competing, and includes well-structured answers to key market research questions such as the following:

- What are the sizes of the target market segments?

- What are the trends for the industry as a whole?

- With what other industries do your services compete?

To conduct this market research, do research online and leverage trade associations that often have the information you need.

4. Analysis of Customers

4. Analysis of Customers

The customer analysis business plan section assesses the customer segment(s) that the company serves. In this section, the company must convey the needs of its target customers. It must then show how its products and services satisfy these needs to an extent that the customer will pay for them.

The following are examples of customer segments: moms, engaged couples, schools, online retailers, teens, baby boomers, business owners, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of business you operate as different segments often have different needs. Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations and income levels of the customers you seek to serve. With regards to psychographic variables, discuss whether your customers have any unique lifestyles, interests, opinions, attitudes and/or values that will help you market to them more effectively.

5. Analysis of Competition

5. Analysis of Competition

All capable business plan writers discuss the competitive landscape of your business. This element of your plan must identify your direct and indirect competitors, assesses their strengths and weaknesses and delineate your company’s competitive advantages. It’s a crucial business plan section.

Direct competitors are those that provide the same product or service to the same customer. Indirect competitors are those who provide similar products or services. For example, the direct competitors to a pizza shop are other local pizza shops. Indirect competitors are other food options like supermarkets, delis, other restaurants, etc.

The first five components of your business plan provide an overview of the business opportunity and market research to support it. The remaining five business plan sections focus mainly on strategy, primarily the marketing, operational, financial and management strategies that your firm will employ.

6. Marketing, Sales & Product Plan

6. Marketing, Sales & Product Plan

The marketing and sales plan component of your business plan details your strategy for penetrating the target markets. Key elements include the following:

- A description of the company’s desired strategic positioning

- Detailed descriptions of the company’s product and service offerings and potential product extensions

- Descriptions of the company’s desired image and branding strategy

- Descriptions of the company’s promotional strategies

- An overview of the company’s pricing strategies

- A description of current and potential strategic marketing partnerships/ alliances

7. Operations Strategy, Design and Development Plans

7. Operations Strategy, Design and Development Plans

These sections detail the internal strategies for building the venture from concept to reality, and include answers to the following questions:

-

- What functions will be required to run the business?

- What milestones must be reached before the venture can be launched?

- How will quality be controlled?

8. Management Team

8. Management Team

The management team section demonstrates that the company has the required human resources to be successful. The business plan must answer questions including:

- Who are the key management personnel and what are their backgrounds?

- What management additions will be required to make the business a success?

- Who are the other investors and/or shareholders, if any?

- Who comprises the Board of Directors and/or Board of Advisors?

- Who are the professional advisors (e.g., lawyer, accounting firm)?

9. Financial Plan

9. Financial Plan

The financial plan involves the development of the company’s revenue and profitability model. These financial statements detail how you generate income and get paid from customers,. The financial plan includes detailed explanations of the key assumptions used in building the business plan model, sensitivity analysis on key revenue and cost variables, and description of comparable valuations for existing companies with similar business models.

One of the key purposes of your business plan is to determine the amount of capital the firm needs. The financial plan does this along with assessing the proposed use of these funds (e.g., equipment, working capital, labor expenses, insurance costs, etc.) and the expected future earnings. It includes Projected Income Statements, Balance Sheets (showing assets, liabilities and equity) and Cash Flow Statements, broken out quarterly for the first two years, and annually for years 1-5.

Importantly, all of the assumptions and projections in the financial plan must flow from and be supported by the descriptions and explanations offered in the other sections of the plan. The financial plan is where the entrepreneur communicates how he/she plans to “monetize” the overall vision for the new venture. Note that in addition to traditional debt and equity sources of startup and growth funding that require a business plan (bank loans, angel investors, venture capitalists, friends and family), you will probably also use other capital sources, such as credit cards and business credit, in growing your company.

10. Appendix

10. Appendix

The appendix is used to support the rest of the business plan. Every business plan should have a full set of financial projections in the appendix, with the summary of these financials in the executive summary and the financial plan. Other documentation that could appear in the appendix includes technical drawings, partnership and/or customer letters, expanded competitor reviews and/or customer lists.

Find additional business plan help articles here.

Expertly and comprehensively discussing these components in their business plan helps entrepreneurs to better understand their business opportunity and assists them in convincing investors that the opportunity may be right for them too.

In addition to ensuring you included the proper elements of a business plan when developing your plan always think about why you are uniquely qualified to succeed in your business. For example, is your team’s expertise something that’s unique and can ensure your success? Or is it marketing partnerships you have executed? Importantly, if you don’t have any unique success factors, think about what you can add to make your company unique. Doing so can dramatically improve your success. Also, whether you write it on a word processor or use business plan software, remember to update your plan at least annually. After several years, you should have several business plans you can review to see what worked and what didn’t. This should prove helpful as you create future plans for your company’s growth.

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Click here to finish your business plan today.

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies that have gone on to achieve tremendous success.

Click here to see how Growthink business plan consultants can create your business plan for you.

1. Executive Summary

1. Executive Summary 2. Company Analysis

2. Company Analysis 3. Industry or Market Analysis

3. Industry or Market Analysis 4. Analysis of Customers

4. Analysis of Customers 5. Analysis of Competition

5. Analysis of Competition 6. Marketing, Sales & Product Plan

6. Marketing, Sales & Product Plan 7. Operations Strategy, Design and Development Plans

7. Operations Strategy, Design and Development Plans 8. Management Team

8. Management Team 9. Financial Plan

9. Financial Plan 10. Appendix

10. Appendix Comprehensive Business Plan Template

Comprehensive Business Plan Template How to Write a Business Plan

How to Write a Business Plan The Perfect Business Plan Outline for a Great Plan

The Perfect Business Plan Outline for a Great Plan Use This Business Plan Format to Expertly Write Your Plan

Use This Business Plan Format to Expertly Write Your Plan 200+ Sample Business Plans

200+ Sample Business Plans Expert Business Plan Consultant

Expert Business Plan Consultant How to Write a Business Plan Executive Summary

How to Write a Business Plan Executive Summary Growthink’s Expert Business Plan Writer

Growthink’s Expert Business Plan Writer What is a Business Plan?

What is a Business Plan? How to Create a One Page Business Plan with Template

How to Create a One Page Business Plan with Template How to Write the Business Plan Management Team Section

How to Write the Business Plan Management Team Section Business Plan Software Options

Business Plan Software Options How To Write A Venture Capital Business Plan

How To Write A Venture Capital Business Plan How Long Should a Business Plan Be?

How Long Should a Business Plan Be? Growthink Reviews

Growthink Reviews